SEMBANG SANTAI TAKAFUL: Letupan Gas : Perlindungan Takaful Kenderaan – “ATL” atau “BER”

April 27, 2025

Buying a Used Car? Here’s Why You Must Check if it’s a BER Vehicle!

May 14, 2025

Actual Total Loss (ATL) Explained: What Car Owners Need to Know

Here’s a handy resource for Malaysian motorists on their rights, the claims process, and tips for handling insurance/takaful situations.

If your car has been involved in a severe accident, stolen, or damaged beyond repair, you may hear the term Actual Total Loss (ATL) during the insurance claim process. Understanding ATL is crucial, as it affects how you receive compensation and what steps you need to take next.

This guide breaks down ATL in simple terms to help car owners navigate the process with confidence.

What is Actual Total Loss (ATL)?

A vehicle is classified as an Actual Total Loss (ATL) when it suffers severe structural damage that compromises its safety and roadworthiness, making it impossible or unsafe to repair.

What is Actual Total Loss (ATL)?

Severe accidents that cause irreparable structural damage.

Once a vehicle is declared an ATL, it can no longer be driven, resold, or reinstated for road use. It will be deregistered with JPJ (Jabatan Pengangkutan Jalan) in accordance with legal requirements.

Beyond Economic Repair (BER) vs. Actual Total Loss (ATL)

There are two types of total loss classifications in an insurance claim:

1. Beyond Economic Repair (BER)

A vehicle is categorised as BER when:

- The repair cost exceeds the insured sum or market value, making it uneconomical to fix.

- The insurer offers a settlement payout based on policy coverage.

- Ownership will be transferred to insurer upon settlement of claim

2. Actual Total Loss (ATL)

A vehicle is considered ATL when:

- It is completely destroyed (e.g., in a fire, flood, or severe accident).

- The payout amount is based on the market value or agreed value as stated in your policy.

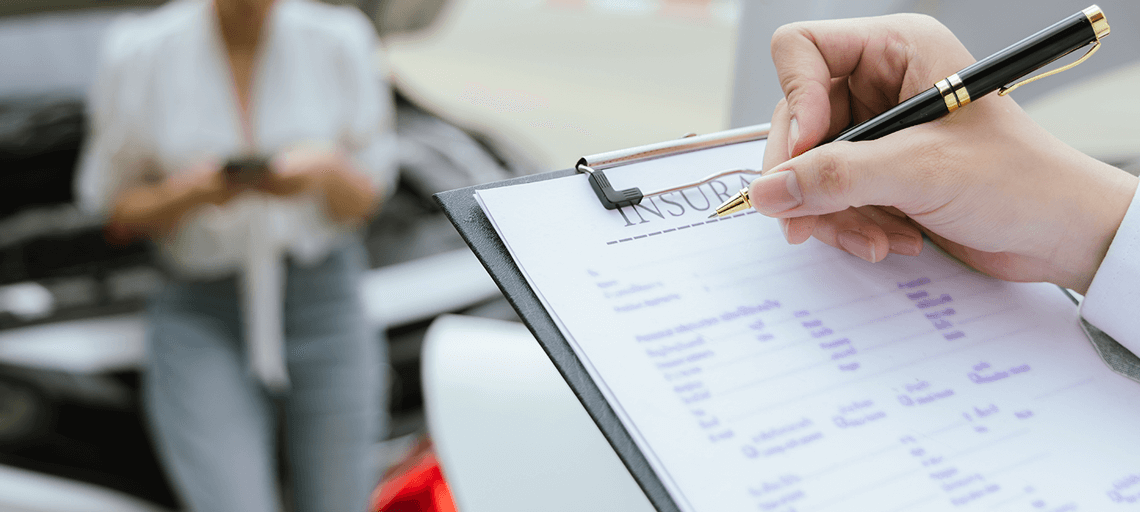

How to Check if Your Vehicle is ATL or BER?

When your insurer or takaful operator (ITO) declares your vehicle a total loss, they will issue a Total Loss Claim Offer Letter. This document specifies whether your claim falls under BER or ATL.

Here’s what to check in the letter:

Claim Type

- Clearly states whether the claim is classified as Beyond Economic Repair (BER) or Actual Total Loss (ATL).

Settlement Amount

- Specifies the payout you will receive based on your insurance policy.

Next Steps

- Lists the documents required to process your claim.

- If BER, it may mention the requirement to transfer ownership of the vehicle to the insurer before payout.

If you’re uncertain about any part of the letter, contact your insurance provider or takaful operator for clarification.

If your insurer confirms your car is a total loss, follow these steps:

Step 1: Review Your Claim Offer Letter

- Ensure you understand whether your claim is ATL or BER.

- Check the settlement amount to see how much you will receive.

Step 2: Complete the Required Paperwork

- Submit any additional documents requested by your insurer.

- If your claim falls under BER, be prepared to transfer vehicle ownership before receiving your payout.

Step 3: Deregistration of the Vehicle

- JPJ deregistration is required for all Actual Total Loss (ATL) vehicles.

- This means the vehicle cannot be driven or resold for road use.

Step 4: Receive Your Insurance Payout

- The payout is based on the market value or agreed value stated in your policy.

- If you have an outstanding car loan, the payout will first be used to settle the loan balance, and any remaining amount will be paid to you.

Step 5: Consider Replacement & Additional Coverage

- If you are purchasing a new vehicle, consider adding GAP (Guaranteed Asset Protection) Insurance to cover any loan shortfalls in future incidents.

- Opt for comprehensive car insurance to safeguard against fire and extend coverage to include natural disasters.

Conclusion

Understanding Actual Total Loss (ATL) vs. Beyond Economic Repair (BER) helps car owners navigate the claims process more efficiently. If your car is declared a total loss, check your claim letter carefully, follow the required steps, and ensure you receive the appropriate payout. If you have any doubts about your claim, always consult your insurance provider or takaful operator for clarification.

This article is part of a ‘Jom, Level Up’ campaign under Phased Liberalisation 2.0, Consumer Education Programme (CEP), by Persatuan Insurans Am Malaysia (PIAM) and Malaysian Takaful Association (MTA).

Disclaimer: The information is provided for general information only. PIAM and MTA make no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.