#YouOttoKnow: How to choose the right motor insurance or takaful

October 11, 2024

Got into an accident? Key things you must do and how motor insurance/takaful helps.

October 27, 2024Claims, Repairs and Disputes

Road accidents can happen at any time. When an unexpected accident happens, it can leave us feeling confused, which may result in us seeking help from unknown parties; especially when navigating through claims, repairs and potential disputes.

This quick guide can be your roadmap to be fully informed on the correct procedures to be adopted in the event of an accident, to ensure that your interest as a consumer is protected.

Types of cover

Third Party cover: This insurance policy/takaful certificate insures you against claims for bodily injuries or deaths caused to other persons (known as the third party), as well as loss or damage to third party property caused by your vehicle.

Third Party, Fire and Theft cover: This policy provides insurance/takaful protection against claims for third party bodily injury and death, third party property loss or damage, and loss or damage to your own vehicle due to accidental fire or theft.

Comprehensive cover: This insurance policy/takaful certificate provides the widest coverage, i.e. third party bodily injury and death, third party property loss or damage as well as loss or damage to your own vehicle due to accidental fire, theft or an accident.

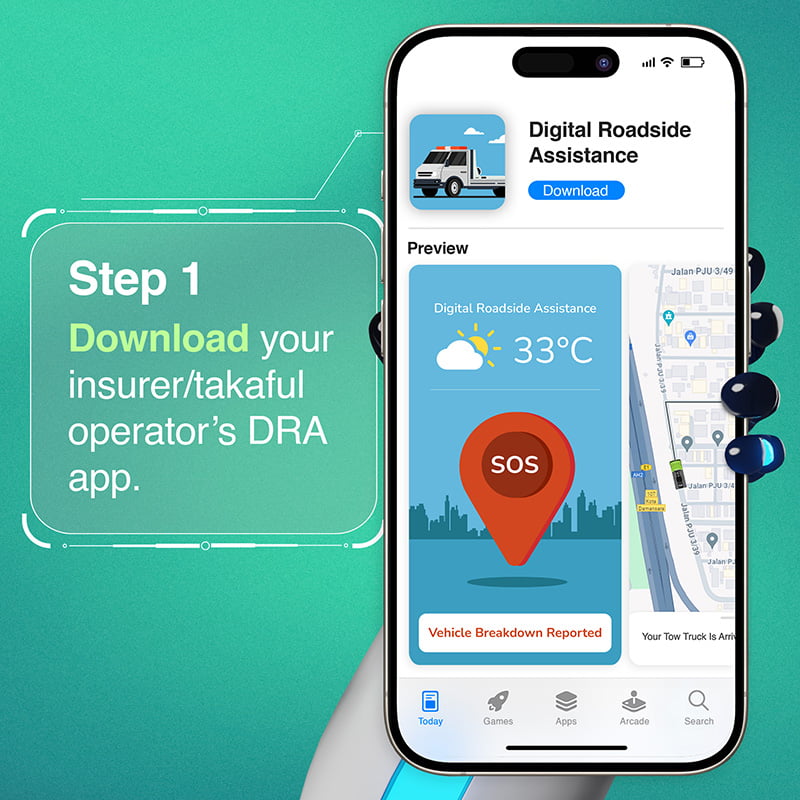

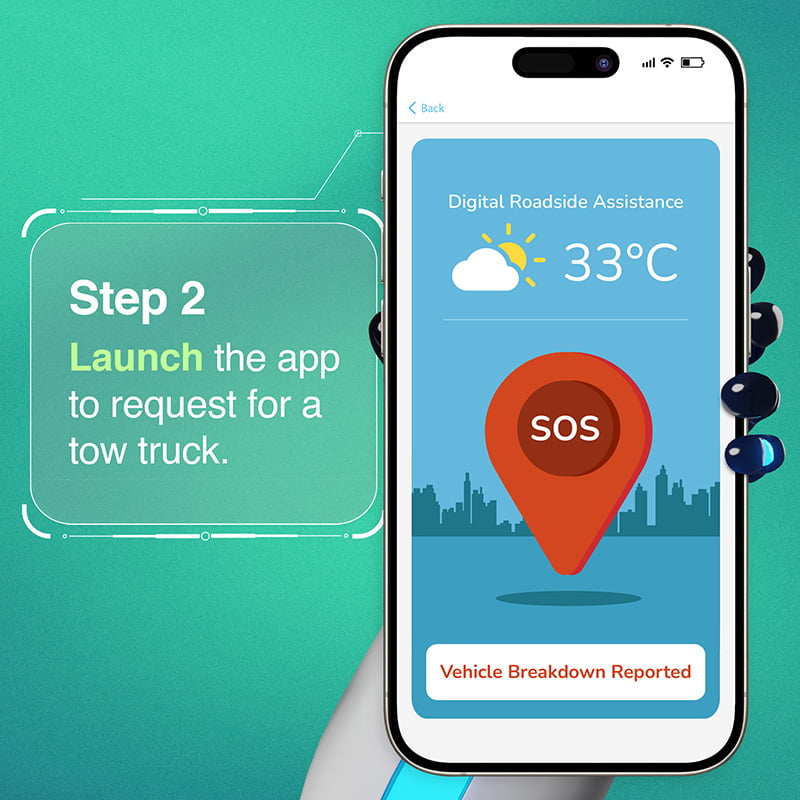

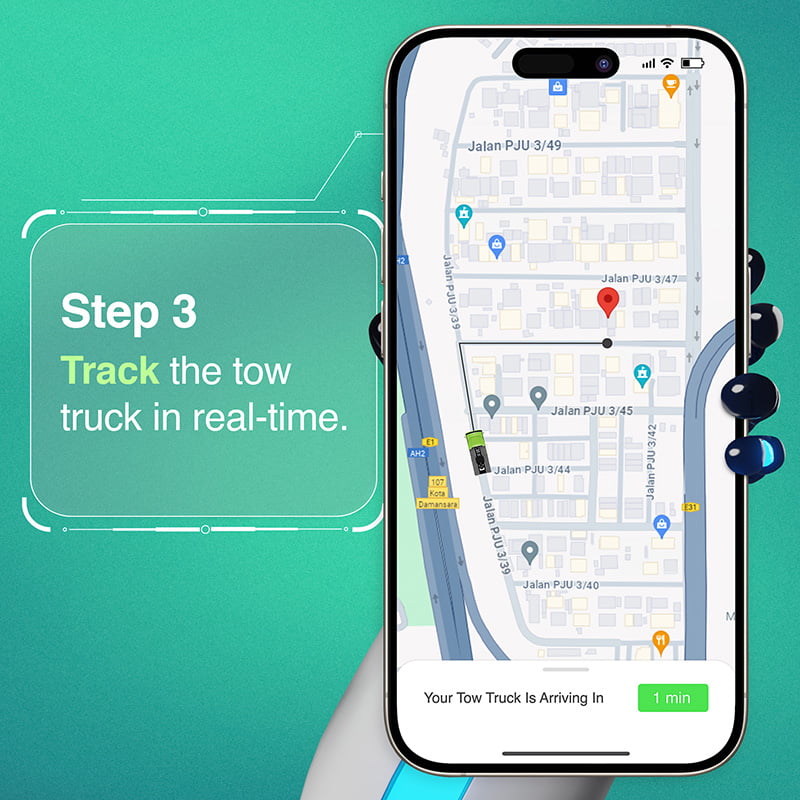

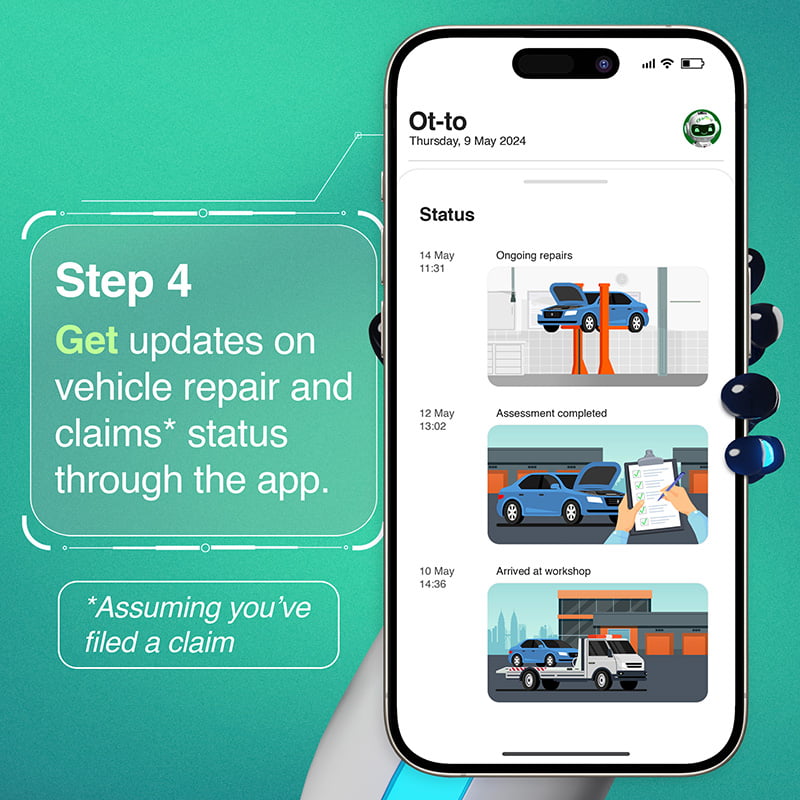

How to use DRA app?

Note: Images above are for illustration purposes only.

Understanding the claims process

Once you have lodged a police report, you can proceed to make a claim with your insurance company/ takaful operator.

If you have comprehensive cover and the third party that knocked your car is clearly at fault, you are advised to submit your Own Damage Knock-for-Knock (OD-KFK) claim to expedite claims processing. Your NCD entitlement will not be affected and you can claim the excess that you had paid from the insurer/takaful operator of the third party.

For damage claims, always seek advice from the insurer/takaful operator or agent on the type of documents required for claim processing, whether it is to be submitted to your own insurer/takaful operator or submit to the other party’s insurer/takaful operator within 7 days of the date of accident/loss if you are not physically disabled or hospitalised following the accident.

For injury claims, direct to the insurer/takaful operator concerned within 30 days or as soon as practicable if you are physically disabled or hospitalised as a result of the accident.

If you choose to pursue a motor claim involving third party bodily injury and death or third party property damage directly with the driver’s insurer/takaful operator, always ensure that the compensation that you receive is adequate.

Ot-to Guide 1

Repairs and workshops

Insurance companies and takaful operators have a panel of authorised repairers throughout Peninsular Malaysia, Sabah and Sarawak where you can get your vehicle repaired. These repairers have agreements with insurance providers or takaful operators to not only streamline the repair process, making it faster and more convenient for policyholders or certificate holders but also ensure competitive rates and value-added services like warranty for repair works performed and roadside assistance and towing services.

Alternatively, the insurer or takaful operator will send an insurance loss adjustor to assess the damage to your vehicle, after which the insurer/takaful operator will authorise repairs. The insurer/takaful operator will authorise repairs subject to satisfactory claim form being submitted together with the relevant documents.

Ot-to Guide 2

Check if you have an Excess or Betterment clause in your policy/certificate.

If Excess is included, you must pay the excess amount direct to the repairer. The excess is that part of the claim that you have agreed will be borne by you. The excess is payable regardless of who is at fault. Do note that excess does not apply to any loss or damage caused by fire, explosion, lightning, burglary, housebreaking, theft, third-party property damage or bodily injury claims.

Example

- Upon assessment, claim payable is RM10,000.

- Policy/certificate carries excess of RM500.

- You’ll have to bear the first RM500.

- Insurer/takaful operator will pay the balance of RM9,500.

Note that there is also the Compulsory Excess where you have to bear an additional excess of RM400 if you or the person driving your car:

- is under 21 years old;

- holds a Provisional (P) or Learner (L) driver’s license; or

- is not named in the Schedule as a named driver.

Ot-to Guide 3

Gentle reminder: If you’re claiming under OD-KFK, you can claim the excess that you paid from the insurer/takaful operator of the third party.

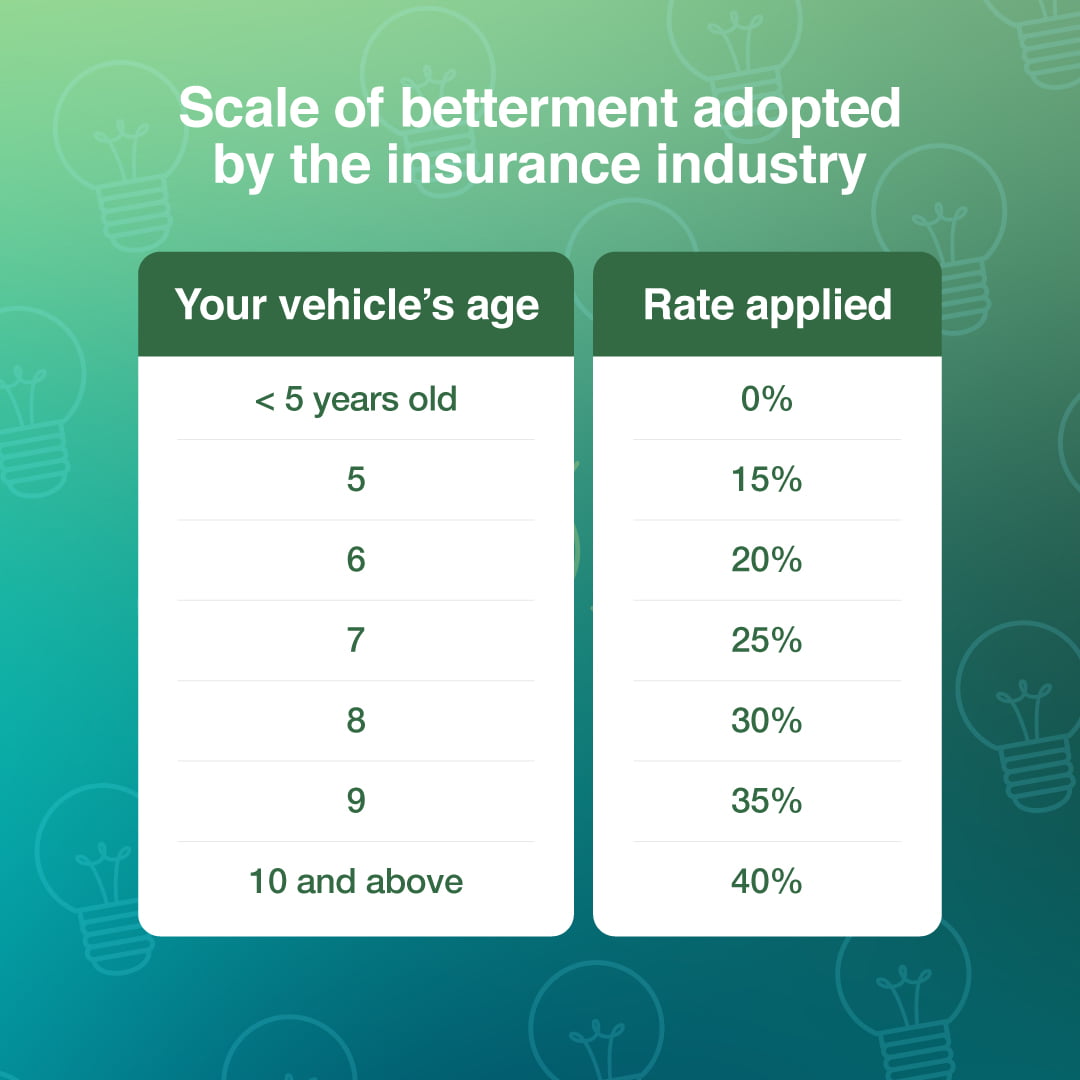

As for Betterment, it refers to the replacement of a damaged car part with a brand new original franchise part after an accident claim. If new original parts are used to repair your car and as a result of which your car is in a better condition than it was before the damage, you would be required to contribute to its betterment, a proportion of the costs of such new original parts. Your contribution would be according to the following scale.

| A. As a locally assembled car | Date of Original Registration |

| B. As a new imported Completely Built Unit (CBU) car | Year of Manufacture |

| C. As an imported second-hand / used / reconditioned car | Year of Manufacture |

Resolving disputes

Disputes can arise during the claims process, especially if there’s disagreement between you and your insurance provider/takaful operator about the extent of the damages or the payout amount. If that happens, it’s important to know your rights and the proper channels for dispute resolution.

If you’re dissatisfied with the way your claim is being handled and the issue on hand is not resolved even after you have written to your insurance company’s/takaful operator’s branch manager and to its head office, you can escalate your complaint to PIAM, MTA or Ombudsman for Financial Services (OFS), an independent body that resolves banking and insurance and takaful disputes.

Ot-to Guide 4

Remember: Throughout the process, keep detailed records of all communications and documents related to your claim. This will be crucial if your dispute goes to mediation.

Checklist of items to remember

Read your policy, and pay particular attention to advice on claims and conditions that apply.

It is your responsibility to keep your vehicle in good order. An insurance policy/takaful certificate does not cover the costs of maintaining your vehicle.

You have to take reasonable steps to prevent a loss occurring – and, if it happens, do what you can to prevent further damage.

It is up to you to understand the extent of your coverage. Your insurance company will be able to assist you on this matter.

Get in touch with your insurance company promptly and take their advice on what you should do.

Your insurance company will deal as quickly as possible with your claim but this will also depend on getting estimates and other information they need to assess the claim, which can take time.

By understanding the claims process, repair options, and how to navigate disputes, you can ensure a smoother experience in the unfortunate event of an accident. Remember, clear communication and keeping good records are key throughout the process!

This article is part of a ‘Jom, Level Up’ campaign under Phased Liberalisation 2.0, Consumer Education Programme (CEP), by Persatuan Insurans Am Malaysia (PIAM) and Malaysian Takaful Association (MTA).

Disclaimer: The information is provided for general information only. PIAM and MTA make no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.