How to file motor insurance/takaful claims digitally?

December 21, 2024

Claims, Settlements, and Your Rights:A Malaysian Driver’s Handbook

December 23, 2024Drive stress-free with Digital Roadside Assistance (DRA) and digital claims

Picture this: you’re driving home after a long day when suddenly, your car starts acting up. Instead of stressing about who to call, how long you’ll wait, or what it will take to file a claim, what if help was just a tap away?

That’s the promise of today’s digital motor claims and roadside assistance apps. They’re here to make breakdowns, accidents, and little bumps in the road easier to handle for Malaysian motorists.

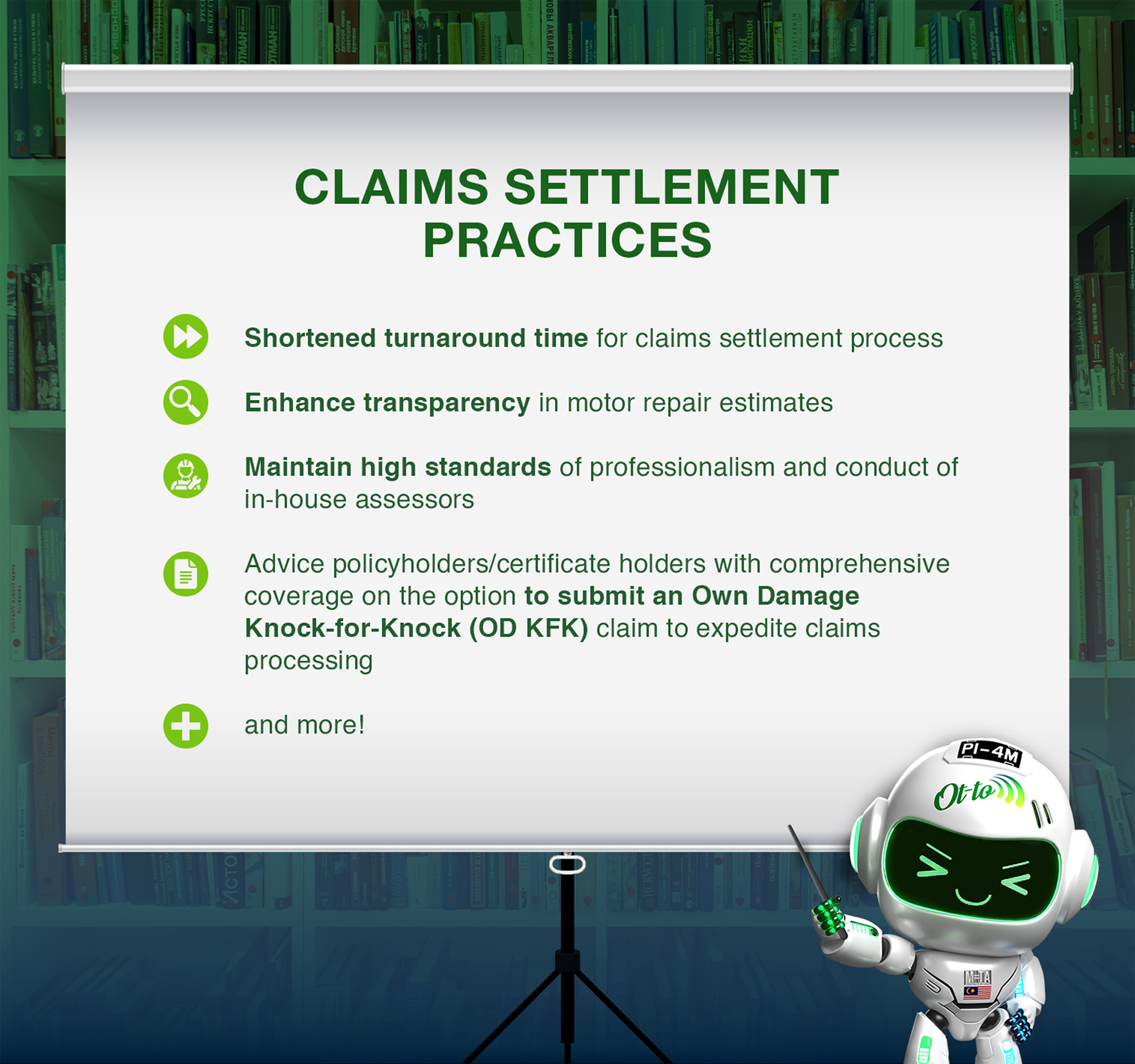

As Bank Negara Malaysia has outlined, these digital tools are crucial for meeting modern demands for faster, more transparent, and efficient insurance or takaful solutions. Additionally, they address common pain points in the claims journey, making it less time- consuming and more accessible to policyholders and certificate holders.

Ot-to Guide 1

Download your motor insurance or takaful provider’s mobile application and manage your entire claims journey – from roadside distress to getting your vehicle repaired – all in one place.

Refer to Jom Level Up’s Resources page for links to general insurers’ and takaful operators’ roadside assistance page

Quick help when you need it most

You can choose the type of assistance you need, and in just a few taps, the app finds an approved provider who’ll be on their way to help you. This support goes beyond just repairs. Digital motor claims are integrated into these apps too. So if you need to file a claim, you can do it right from your phone, wherever you are. This seamless approach means you’re not waiting around or jumping through hoops, but instead you’re getting back on the road faster.

TAP

TRACK

GET BACK

ON TRACK

Easy, streamlined claims

Stay in the loop with real-time updates

A common question drivers have is, What’s going on with my claim? With digital claims, you’ll be informed at every step, from filing to processing and payout. You’ll get notifications on your phone, whether your claim is moving forward, if additional information is needed, or when it’s been approved.

This level of transparency from real-time tracking means you can follow the progress at your convenience. Knowing where your claim stands – and what happens next – gives you control and a greater sense of confidence in the process.

Always ready, day or night

One of the standout perks of digital roadside assistance is the 24/7 availability. Whether it’s early morning or late at night, these apps ensure that support is just a few taps away. This means no matter when you run into trouble, there’s always help around the corner.

For instance, if you’re running errands late and your car won’t start, you can simply open your DRA app, and select the service you require. Not only does this save you time, but it also makes getting help safer, especially if you’re on a quiet road or unfamiliar stretch.

Ot-to Guide 2

Ot-to Guide 3

How to file claims digitally? It’s actually easy!

Check out our article on end-to-end digital claims process here.

A new era of roadside assistance

These digital solutions are changing the way we think about roadside assistance and motor claims. Now, with just a smartphone in hand, motorists can access help, file claims, and stay informed at every stage. It’s not just a system upgrade – it’s a whole new experience that puts control, convenience, and confidence in your hands.

As insurers and takaful operators continue to enhance these tools, we can expect even more innovation in the years ahead. With additional features like AI-powered solutions, the digital motor claims journey and roadside assistance experience will continue to evolve, making life on the road safer and more convenient for Malaysian motorists everywhere.

Ot-to Guide 4

Did you know that insurers and takaful operators have AI chatbots to transform your online experience?

They can assist you by providing product information, provide status updates on your claims,tell you about your NCD, advise on safe payment methods, help you with portal access, locate a branch that’s closest to you, and many more!

This article is part of a ‘Jom, Level Up’ campaign under Phased Liberalisation 2.0, Consumer Education Programme (CEP), by Persatuan Insurans Am Malaysia (PIAM) and Malaysian Takaful Association (MTA).

Disclaimer: The information is provided for general information only. PIAM and MTA make no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.