The future of insurance/takaful claims is digital!

December 2, 2024

Drive stress-free with Digital Roadside Assistance (DRA) and digital claims

December 22, 2024How to file motor insurance/

takaful claims digitally?

Did you know that most insurers/takaful operators in Malaysia offer some form of digital solution through their websites or mobile apps? Yes, that’s actually a fact, and it is through these digital ways that claimants can be alerted to updates instantly and have a better and more immediate view of the process.

Some insurers/takaful operators also have 24/7 road assistance service which enables their customers to contact the service centre at any time to receive help, assistance or towing of the damaged vehicle.

Not only that! Digital photographs of the loss or accident-damaged vehicle can also be sent via the same system. All these digitalisation enablers reduce the lifecycle of motor claims and make the approval process more efficient, which means that you can file a claim from the comfort of your home.

These initiatives are in line with Bank Negara Malaysia’s (BNM) call to improve motorists’ claims experience and outcomes, as set out in its Financial Sector Blueprint 2022-2026.

Why is digitalisation important?

Imagine this—at the scene of an accident or vehicle breakdown, you could be exposed to questionable or even harmful practices. Unsolicited parties could show up at an accident scene to take advantage of accident victims by pressuring them to allow their vehicles to be towed away without notifying the relevant insurers/takaful operators, or deal with unknown parties to handle aspects of the claim. Victims may be made to pay unnecessary fees.

Damaged vehicles towed to unauthorised repairers also raise safety concerns from the use of non-genuine parts or sub-standard repairs. These practices contribute to greater risks of insurance/takaful fraud and exaggerated claims due to inflated costs of repairs and parts.

Additionally, manual claims processes have long turnaround times to approve and settle claims. Digital solutions like web or mobile apps can address many of these issues. By linking each party within the claims process, digitalisation can provide consumers with a more efficient and seamless experience.

Ot-to Guide 1

Steps to filing a motor claim digitally

It’s important that all insurance policyholder/certificate holders are aware and knowledgeable on the process of making insurance/takaful claims. The following guidelines will help make lodging a claim, a more convenient process.

The appointment of an adjuster will depend on the complexity of the case3

- Report

Report a loss or damage incident to the police immediately.

Related article: Got into an accident? Key things you must do and how motor insurance/takaful helps.

Ot-to Guide 2

Quick claims guide for motor accidents. The 3 key steps are:

- Call your insurer or takaful operator

- Gather evidence

- Lodge police report

Notify insurer/takaful operator

Contact your insurer/takaful operator immediately to notify them of the loss or damage. You can use the app, log in to their Claims Service Portal, or contact their hotline. If you’re not using the app, then the notification will come from the authorised repairer (unless it’s for windscreen reimbursement, which is usually done within a working day).

Have the following documents or information ready:

Date of loss/incident

Insured name/NRIC No/policy number

Contact number/e-mail address

Brief description of damage

Note: The required documents listed are not all-inclusive, as the need for additional information/document may become necessary during the claims process. Always keep the communications between yourself and your insurer/takaful operator open and cordial.

- Cooperate

Cooperate with the insurer’s/takaful operator’s appointed Adjusters or Surveyors to assist in investigations and finalisation of report. -

Return

Return duly completed Claim Form together with relevant documentation as requested.

- If the accident was your fault, make an Own Damage claim.

- If the accident wasn’t your fault, Own Damage Knock-for-Knock (OD-KFK) claim.

- Damage to your car in a road accident caused by the other party.

- Other financial losses e.g. CART, Excess, etc.

- Submit the following to your insurer/ takaful operator:

- Completed claim form

- Original copy of police report

- Copy of driver’s and policyholder’s/certificate holder’s identity card and driving licence

- Copy of vehicle ownership certificate

- Photos of accident scene and damages to vehicle

- Police letter informing which

party is compounded for the road traffic offence

- Send your car to insurer’s/takaful operator’s authorised repairer

- Appoint an adjuster to evaluate cost of your car’s damage

- Submit to the other party’s insurance company/takaful operator:

- Original copy of police report

- Copy of driver’s and

policyholder’s/certificate holder’s

identity card and driving licence - Copy of vehicle ownership

certificate - Adjuster’s report

- Bill of repair costs of your car

- Photos of accident scene and

damages to vehicle - Police letter informing which party

is compounded for the road traffic offence

Source: Bank Negara Malaysia

- If the accident was your fault, make an Own Damage claim.

- If the accident wasn’t your fault, Own Damage Knock-for-Knock (OD-KFK) claim.

- Submit the following to your insurer/ takaful operator:

- Completed claim form

- Original copy of police report

- Copy of driver’s and policyholder’s/certificate holder’s identity card and driving licence

- Copy of vehicle ownership certificate

- Photos of accident scene and damages to vehicle

- Police letter informing which

party is compounded for the road traffic offence

- Damage to your car in a road accident caused by the other party.

- Other financial losses e.g. CART, Excess, etc.

- Send your car to insurer’s/takaful operator’s authorised repairer

- Appoint an adjuster to evaluate cost of your car’s damage

- Submit to the other party’s insurance company/takaful operator:

- Original copy of police report

- Copy of driver’s and

policyholder’s/certificate holder’s

identity card and driving licence - Copy of vehicle ownership

certificate - Adjuster’s report

- Bill of repair costs of your car

- Photos of accident scene and

damages to vehicle - Police letter informing which party

is compounded for the road traffic offence

Source: Bank Negara Malaysia

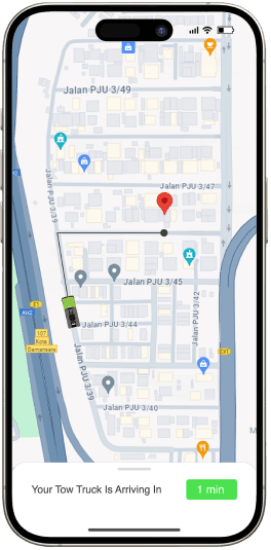

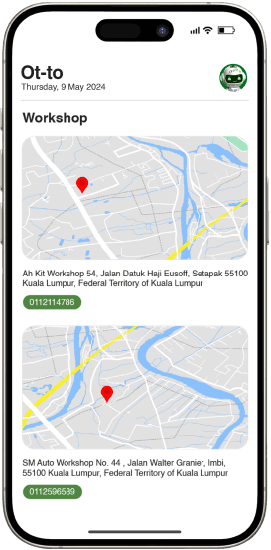

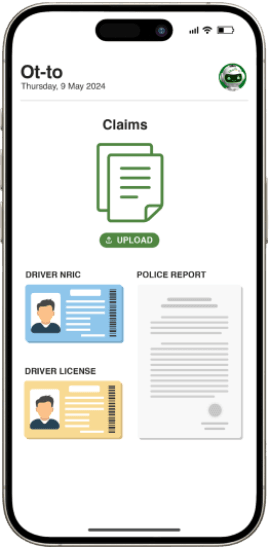

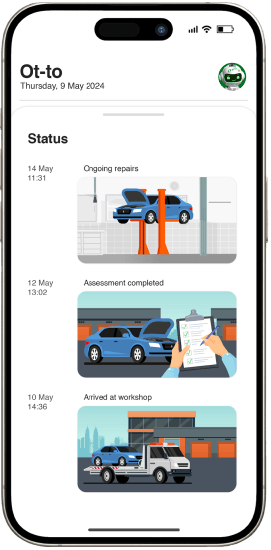

End-to-end digital motor claims process via a mobile app

If you’re using your insurer’s or takaful operator’s digital roadside assistance app, here are the steps to file a claim.

STEP 1

Request for DRA via web and/or mobile app

Do not panic in the event of the accident or breakdown. Remember that the DRA is now a click or call away and touts do not have any rights to your vehicle. Capture photo and video evidence to support any investigation or claims.

STEP 2

Monitor registered tow truck’s location in real time

Check for details of tow trucks (e.g. licence plate number) and keep track of their location and expected arrival time.

STEP 3

Choose preferred workshop from list of authorised repairers

Inform your ITO or assistance provider about your workshop preference or select from the list of panel repairers.

STEP 4

Lodge accident reports digitally, including upload of photo and video evidence

Log into your ITO’s website or mobile app to submit your claim documents.

STEP 5

Keep track of claims and repairs status via mobile app and/or SMS notifications

Repaired vehicle ready for pick up upon notification from your ITO or repairer.

Note: The above diagram is for illustration only. The actual user interface may vary across participating ITOs.

Source: Bank Negara Malaysia

Digital transformation is absolutely an enabler. The faster the motor insurance/takaful industry adapts to digital solutions, the better the outcomes will be. Motor claims of the future will be exciting, speedy, efficient, transparent, innovative, and digitally driven. Together with the friendly and helpful customer service support of insurers/takaful operators, the end-to-end claims experience will be brought to life!

This article is part of a ‘Jom, Level Up’ campaign under Phased Liberalisation 2.0, Consumer Education Programme (CEP), by Persatuan Insurans Am Malaysia (PIAM) and Malaysian Takaful Association (MTA).

Disclaimer: The information is provided for general information only. PIAM and MTA make no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.