Don’t get tow-tally stressed! A guide to managing car troubles

December 2, 2024

How to file motor insurance/takaful claims digitally?

December 21, 2024The future of insurance/

takaful claims is digital!

In 2022, Bank Negara Malaysia (BNM) continued to encourage general insurers and takaful operators (GITO) to improve customers’ claims experience and outcomes by going digital, as outlined in the Bank’s Financial Sector Blueprint 2022-2026.

Based on a Customer Satisfaction Survey 2022 (CSS 2022) conducted by Persatuan Insurans Am Malaysia (PIAM), Malaysian Takaful Association (MTA) and Life Insurance Association of Malaysia (LIAM) in collaboration with Bank Negara Malaysia (BNM), 76% of general insurance/takaful customers convey a positive sentiment about their insurance/takaful experience. So, the industry is certainly moving in the right direction!

Ot-to Guide 1

You can get help from anywhere, at any time, with just a few taps on your mobile phone. Be it the Digital Roadside Assistance (DRA) app, messaging apps (Telegram, WhatsApp, etc), email or hotline, remember to download and/or key in all the important details.

A transformative and collaborative experience

Collaboration among GITOs and key parties in the claims value chain is crucial to reshaping an end-to-end digital motor claims journey. This could include the deployment of Digital Roadside Assistance (DRA) solutions via the web and mobile platforms by general insurers and takaful operators in the market.

This approach allows consumers to effortlessly manage every aspect of their claims journey digitally. From reporting an accident or incident to a GITO, to receiving approval status updates, everything can be done conveniently from their devices.

Furthermore, the integration of technologies like telematics, data analytics, and process automation not only speeds up the claims process, but also improves accuracy, ensuring a smoother experience for everyone.

STEP 1

Request for DRA via web and/or mobile app

Do not panic in the event of the accident or breakdown. Remember that the DRA is now a click or call away and touts do not have any rights to your vehicle. Capture photo and video evidence to support any investigation or claims.

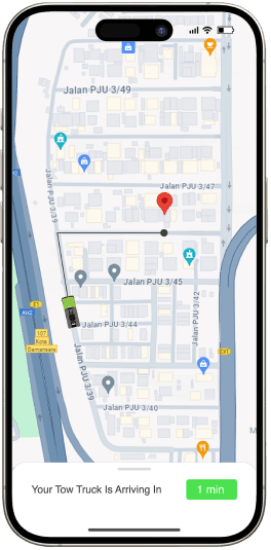

STEP 2

Monitor registered tow truck’s location in real time

Check for details of tow trucks (e.g. licence plate number) and keep track of their location and expected arrival time.

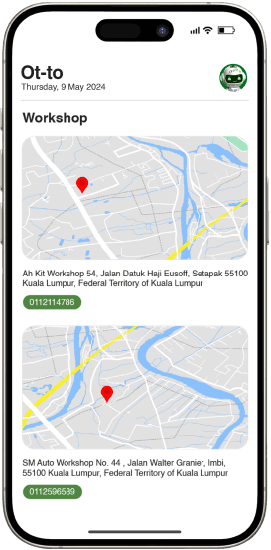

STEP 3

Choose preferred workshop from list of authorised repairers

Inform your ITO or assistance provider about your workshop preference or select from the list of panel repairers.

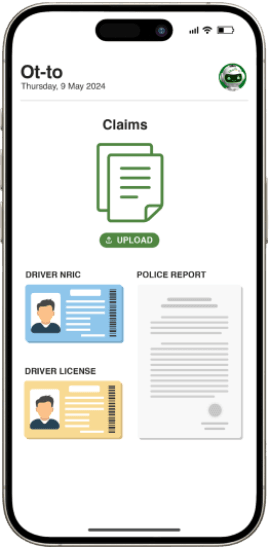

STEP 4

Lodge accident reports digitally, including upload of photo and video evidence

Log into your ITO’s website or mobile app to submit your claim documents.

STEP 5

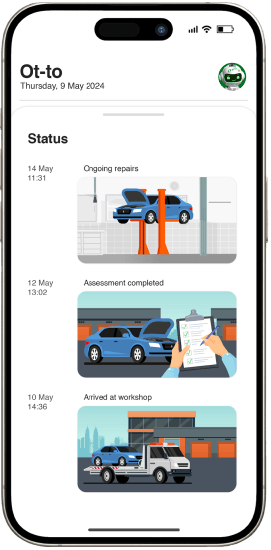

Keep track of claims and repairs status via mobile app and/or SMS notifications

Repaired vehicle ready for pick up upon notification from your ITO or repairer.

Note: The above diagram is for illustration only. The actual user interface may vary across participating ITOs.

Source: Bank Negara Malaysia

Benefits of an increasing digital insurance/takaful landscape

Digital transformation is not just a buzzword. It’s a reality that’s reshaping how claims are managed and processed in Malaysia. Here’s how digital offerings can help motorists like us.

Faster and smoother claims: With mobile apps and online platforms, claims can be submitted instantly. This allows insurers and takaful operators to get a head start on assessing the damage, potentially speeding up the repair process and getting you back on the road faster.

Transparency at your fingertips: Digital platforms offer real-time updates, allowing you to track your claim's progress every step of the way. This offers peace of mind, knowing that you are always in control of your claims process.

Convenience on the go: With digital tools, you can file claims, submit supporting documents, get real-time updates, and even communicate with your insurer or takaful operator directly from your smartphone or computer.

Enhanced accuracy: Digital platforms reduce the chances of errors, ensuring that your claims are processed swiftly, leading to a hassle-free experience. This not only accelerates the process but also ensures a smoother experience for motorists.

Beyond convenience: This digital transformation can also result in a more personalised claims experience. In addition to smart and helpful chatbots, AI can analyse historical data and estimate repair costs, potentially leading to faster settlements. Digital tools can also offer resources and support throughout the claim process, making a stressful situation a little less overwhelming.

Ot-to Guide 2

AI chatbots are like your assistant, available 24 hours a day, 7 days a week.

It can assist you by providing product information, status updates on your claims and NCD, help you with portal access, locate a branch closest to you, and many more!

What can you do?

Embrace the change! When selecting a motor insurance or takaful plan, ask about the GITO’s digital claims platform. Get acquainted with the app or online portal and explore its features. The more familiar you are with these tools, the smoother your claims experience will be!

The future of digital insurance and takaful in Malaysia

Today’s insurance/takaful landscape requires agile and adaptive solutions. So, where do we go from here? We’ll say, infinity and beyond! Here are some of the possibilities

Increasing access and affordability to insurance/takaful, and InsurTechs have the potential to bridge the financial inclusion gap by providing agile, affordable and customised on-demand solutions.

Adapt to emerging tech-enabled innovations in insurance/takaful solutions to address the needs of motorists today and tomorrow.

Promoting competition and greater efficiency by introducing diverse product innovations and providing a better customer experience.

As digital transformation continues to revolutionise the motor insurance and takaful industry in Malaysia, motorists are set to benefit from a more efficient, transparent, and customer-centric claims process. The integration of cutting-edge technologies such as AI, blockchain, and IoT is not only making insurance/takaful more accessible but also more reliable and responsive to the needs of today’s motorists.

This article is part of a ‘Jom, Level Up’ campaign under Phased Liberalisation 2.0, Consumer Education Programme (CEP), by Persatuan Insurans Am Malaysia (PIAM) and Malaysian Takaful Association (MTA).

Disclaimer: The information is provided for general information only. PIAM and MTA make no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.